In the Immersve-conducted KYC mode, partner application directs their users to complete KYC through the Immersve UI. This contrasts with Partner Conducted KYC mode where Immersve is not directly involved with partners' cardholders.

We recommend this mode of KYC for partners not obligated to perform KYC as part of their main product, like crypto wallets. That's because implementing one's own KYC process can require a significant effort.

Integration steps

The following steps are for manual integration via a terminal. An integrating application should implement this flow with whatever technology stack is convenient.

Prerequisites

This guide assumes that the partner has already obtained an access token or API keys, and has the card program and funding source IDs ready.

token="<your_access_token>"card_program_id="<your_card_program_id>"funding_source_id="<funding_source_id>"Request spending prerequisites

To begin the KYC process, call spending prerequisites specifying KYC type as immersve-conducted. Optionally, a redirectUrl can be provided to indicate where the user should be redirected upon completion of the KYC process.

If KYC is required, the response to the spending prerequisites request will contain a URL, where the user must be redirected to complete the KYC verification.

If Immersve already has complete KYC information for the individual owning the wallet, in any of the regions supported by the requested card program, the user will not be required to go through KYC.

Once Immersve conducted KYC has been completed for an Individual, the supported region associated with the wallet of the individual cannot be changed.

In the event that an individual wished to go through KYC in another supported region, a new wallet would be required.

If KYC is not required, is already in progress, or the maximum number of retries has been exceeded, the URL will not be returned and the status will indicate the problem. See the Get Spending Prerequisites endpoint reference for more details on possible statuses.

Example Request:

curl -X POST "https://test.immersve.com/api/spending-prerequisites" \ -H 'Content-Type: application/json' \ -H "Authorization: Bearer $token" \ --data '{ "cardProgramId": "'${card_program_id}'", "fundingSourceId": "'${funding_source_id}'", "spendableAmount": 100, "spendableCurrency": "USD", "kycType": "immersve-conducted", "kycRedirectUrl: "https://app.example.io", }'Example Response:

{ "prerequisites": [ { "stage": "kyc", "status": "action-required", "type": "kyc", "actionType": "follow_kyc_url", "params": { "status": "kyc_required", "kycUrl": "https://verify.test.immersve.com/kyc/session/hg40904ddkr43?code=r938j9g" } }, ]}Supply Contact Details (Optional)

If you would like to supply the user's contact details ahead of time, you can do so by calling the contact details endpoint, before starting the KYC process. This will then allow the user to check and update them as part of the Immersve Conducted KYC process.

Immersve will not perform validation of a user's contact details.

Immersve requires users contact details (phone number and email) for the following reasons, this should be explained to customers:

- Adding cards to Apple/Google Pay wallets (X-Pay)

- Performing 3DS validation for online transactions

If a user doesn't provide contact details, they risk online transactions being rejected and might not be able to add cards to X-Pay wallets.

Before you share contact details with Immersve you must collect user consent via a checkbox. This can be done at the same time as KYC information sharing.

curl -X PATCH "https://${imsv_api_host}/api/accounts/${cardholder_account_id}/contact-details" \ -H "Content-Type: application/json" \ -H "Authorization: Bearer $token" \ --data '{ "email": { "emailAddress": "joe@cardholder.email", }, "phone": { "phoneNumber": "+64123456789", } }'User goes through the KYC flow

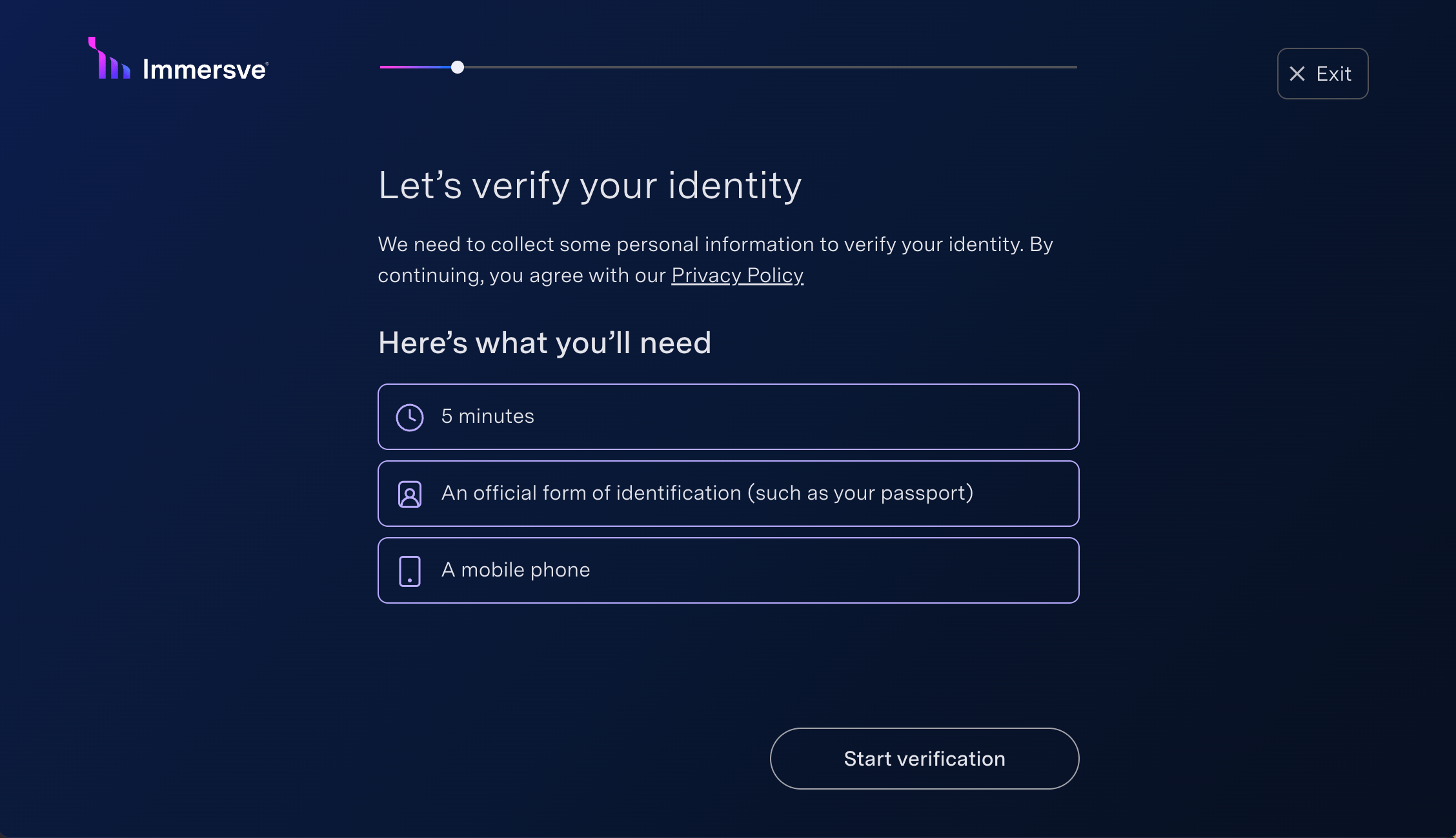

Upon being redirected to the Immersve KYC page, the user will go through the process that involves the collection of the user's address and the verification of their identity through document and biometry (facial scan) collection.

At the end of the process they are presented with a screen indicating that their profile is under review. The user does not have to stay on the page to know the outcome, as it will be communicated via email. If they stay on the page, it will eventually inform about success or failure.

Upon exiting the page, users are sent back to the redirectUrl provided initially. If no URL was provided, exiting leads to closing the browser tab.

Confirmation of KYC Completion

Once redirected, check the spending prerequisites again to ensure no further KYC actions are required. Once there is no KYC prerequisite returned, and given all other checks are completed, the cardholder will be allowed to create and use their Immersve card.

Example Request:

curl -X POST "https://test.immersve.com/api/spending-prerequisites" \ -H 'Content-Type: application/json' \ -H "Authorization: Bearer $token" \ --data '{ "cardProgramId": "'${card_program_id}'", "fundingSourceId": "'${funding_source_id}'", "spendableAmount": 100, "spendableCurrency": "USD", "kycType": "immersve-conducted", "kycRedirectUrl: "https://app.example.io", }'Example Response:

{ "prerequisites": []}Testing

Overview

We have configured our test environment to ensure random identity information is received by our systems regardless of what identity document and facial scan has been captured during the course of Immersve Conducted KYC.

This highly increases the chances of receiving a successful KYC result when testing.

In test, you should be be able to use any valid supported identity document (regardless of region) when going through Immersve KYC.

You must always perform a facial scan of a real person.

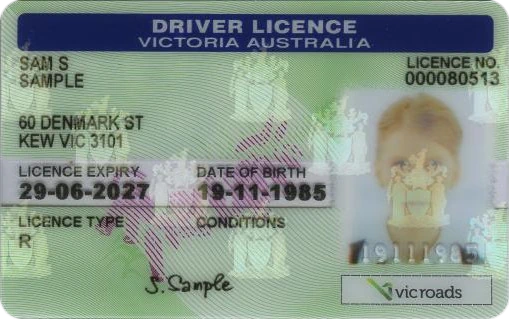

Test ID Documents

If you're not comfortable using your identity documents, we have provided a dummy drivers license that can be used instead of a real identity document. The facial scan must be done with the a real person's face, however.